Financial literacy is a critical life skill, yet it remains absent from the core educational curriculum in the UK. As more young people enter adulthood without a clear understanding of personal finance, the consequences can be far-reaching—leading to debt, limited savings, and reduced financial mobility. For marginalized communities, particularly Black children who disproportionately belong to lower-income, deprived areas, the lack of financial education exacerbates existing inequalities. Making financial literacy a mandatory part of the curriculum is not only a matter of educational reform but also a necessary step toward empowering underserved communities.

The Importance of Financial Literacy

Financial literacy refers to the knowledge and skills needed to make informed decisions about managing money. It includes understanding how to budget, save, invest, manage debt, and plan for retirement. In today’s increasingly complex financial landscape, where credit cards, loans, and student debt play major roles in the average person’s life, knowing how to navigate these systems is essential.A financially literate population is more likely to:

– Make informed decisions about borrowing and spending.

– Build wealth and avoid debt traps.- Achieve financial independence earlier in life.

– Contribute to economic growth and stability.Without these skills, young people are more vulnerable to financial pitfalls, including overspending, excessive borrowing, and a lack of savings for emergencies or retirement.

The Need for Financial Literacy in Black and Deprived Communities

Unfortunately, financial inequality is widespread across the UK, and its impact is felt most strongly in minority and deprived communities. Statistics show that Black families, on average, have significantly lower wealth than their white counterparts. Many of these disparities are rooted in systemic issues, such as unequal access to employment opportunities, housing discrimination, and generational poverty. As a result, Black children are often born into economically disadvantaged conditions, which continue to limit their access to the resources needed for upward mobility.

Key Challenges Faced by Minority Communities:

1. Lower Average Income: Many Black families live in areas with fewer employment opportunities, leading to lower wages and job security.

2. Higher Debt Burdens: Black students are more likely to take out student loans to fund their education, leaving them with greater debt than their peers. This financial burden can stifle wealth-building opportunities later in life.

3. Limited Access to Financial Education: Deprived areas tend to have fewer resources available to teach young people about managing finances. This often means fewer community programs or schools offering extracurricular activities focused on money management.

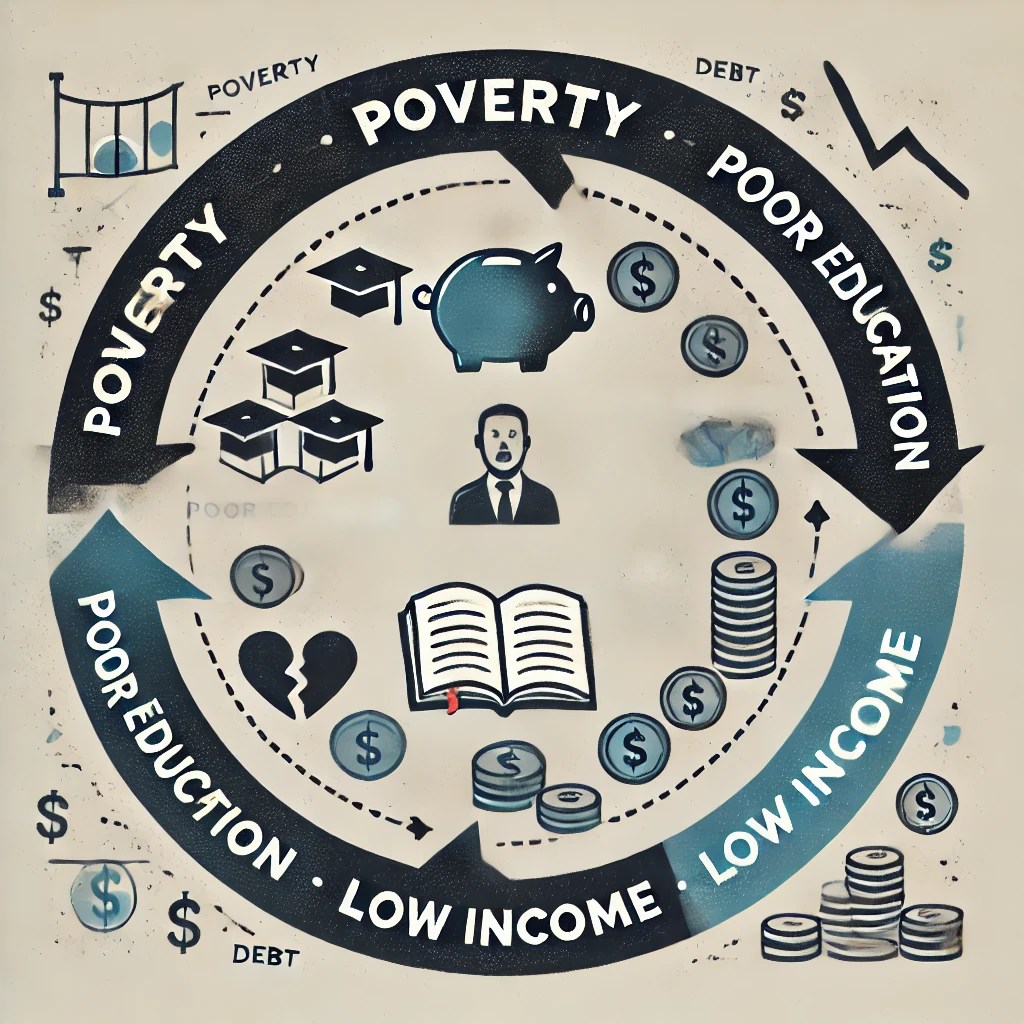

4. Generational Poverty: Many families from marginalized backgrounds face systemic barriers that prevent wealth accumulation across generations. Without the financial know-how to break the cycle, poverty perpetuates itself, leaving the younger generation at a disadvantage.

These factors make financial literacy a crucial tool for empowering minority communities and creating a more level playing field. Teaching financial management skills at an early age can help Black children and those from other disadvantaged groups break out of this cycle.

Why Financial Literacy Should Be in the UK Curriculum

Given the impact that financial literacy can have on an individual’s life, it’s surprising that it isn’t a mandatory part of the national curriculum in the UK. Here’s why it should be:

1. Equips Students with Real-World Skills

Many young people leave school knowing algebra but not how to balance a budget. By including financial literacy in the curriculum, schools can equip students with the knowledge they need to navigate the real world. Understanding how to manage debt, build credit, and plan for long-term financial security are essential life skills that everyone should learn, particularly for those from economically disadvantaged backgrounds.

2. Reduces Economic Disparities

Financial literacy can help bridge the wealth gap. Students from low-income or minority backgrounds are often the least likely to receive financial guidance at home. By integrating financial education into the school system, we can level the playing field and provide all students with the tools they need to achieve financial success.

3. Prepares Students for Future Opportunities

Financial literacy does more than prevent financial mismanagement—it opens doors to wealth-building opportunities. Learning about investments, savings accounts, and other financial instruments can help students from deprived backgrounds build wealth over time. With the knowledge of how to grow their money, these students can break out of the poverty cycle and contribute to the economy.

4. Encourages Better Decision-Making

A lack of financial knowledge often leads to poor decision-making. Many young people fall into the trap of high-interest credit card debt, predatory payday loans, or unnecessary overspending. Teaching students about the risks of debt, the importance of budgeting, and how to build credit responsibly can prevent costly mistakes that can take years to recover from.

The Unique Role Financial Literacy Plays in Empowering Black Youth

For Black youth and others from marginalized groups, financial education offers the promise of economic empowerment. It provides the tools needed to break free from the limitations imposed by poverty and systemic inequality. Here are some specific reasons financial literacy is particularly vital for Black children:

1. Breaking Generational Poverty

Financial education can help young people develop wealth-building habits early on. By learning to save, invest, and manage money wisely, Black youth can begin to create financial stability for themselves and future generations, reversing the legacy of generational poverty.

2. Building Economic Independence

Financial independence allows individuals to make choices without being beholden to high-interest loans, debt, or limited financial resources. For Black children growing up in deprived communities, financial literacy represents a pathway to self-sufficiency and empowerment.

3. Challenging Systemic Barriers

With the right financial knowledge, individuals can better navigate the barriers imposed by systemic discrimination, such as limited access to credit or home ownership. By teaching Black youth how to build and maintain good credit, invest wisely, and avoid predatory financial practices, we equip them with the tools they need to overcome these challenges.

Conclusion: A Step Towards Equality and Economic Empowerment

Including financial literacy in the UK curriculum would be a powerful step toward reducing inequality and providing all students—especially those from marginalized and deprived communities—with the knowledge to succeed. The financial challenges faced by Black children in economically disadvantaged areas are part of a broader system of inequality that continues to disadvantage them throughout life. By teaching them how to manage their finances, we can break this cycle and equip the next generation with the skills they need to build a more equitable future.The time to implement financial literacy in the UK curriculum is now. It’s not just about helping individuals manage money; it’s about empowering communities and fostering a more financially inclusive society. For Black children and other minority groups, financial literacy is a key to unlocking economic opportunities, promoting self-reliance, and creating generational wealth.

Leave a comment